- Why BRICS Bank born?

- BRICS Bank vs IMF and World Bank

- How much money does BRICS bank have?

- BRICS Contingency reserve

- BRICS Bank not a totally new concept!

- IMF Quota & Governance: Need for reforms

Why BRICS Bank born?

- BRICS nations have become as big economic power- collectively 1/5th of World GDP and 2/5th of world population. They want to solidify and demonstrate their strength with help of this “new development bank”.

- BRICS nations are disenchanted with Bretton-Woods institutions viz World bank, IMF, GATT (which later became WTO).

- Since their inception in 1944, the IMF and World Bank have not reformed their governance structure, to give more voting and voice to emerging economies. Both dominated by USA and developed countries. Both are out of sync with the new dynamics of world economy.

- Will help defending these five economies from volatility in dollar exchange rate.

- Will help financing high tech projects, infrastructure and sustainable Development in member nations.

- Although IMF and World Bank provides loans but with various conditions imposed. BRICS nations want loan but without having to follow such dictates from the developed world.

- In BRICS bank, the First chairman of the board of governors will be a Russian. First President of the bank will be an Indian. This is difficult in World bank and IMF given the lobbying and uneven voting power.

- In the long run, it’ll make Chinese Yuan as an alternative to US Dollar- for global financial system. Then USA / West imposed ‘sanctions’ against any BRICS will become less effective.

- RBI Governor Rajan- “we did not setup BRICS bank to challenge World bank and IMF. This bank is setup only to provide “patient money” to BRICS nations, because World Bank and IMF are taking too much time to reform themselves.”

BRICS Bank vs IMF and World Bank

Basics compared: IMF, World Bank, BRICS

| Data |

IMF |

World Bank |

BRICS Bank |

| By which summit? |

Bretton Woods, USA |

6th BRICS summit at Fortaleza, Brazil |

| Year |

1944 |

2014, July. Although ops may by 2016. |

| HQ |

Washington |

Shanghai, China. |

| members |

188 |

188 (IBRD); 172 (IDA) |

only five |

| voting power |

Different voting powers based on Quota system. |

Differs according to shareholding and other criteria |

All five members have equal voting power. |

| components |

— |

IBRD, IDA, IFC and MIGA |

— |

| Purpose |

- Loans to solve Balance of Payment (BoP) crisis.

- technical assistance in policy making

- surveillance over International economy

|

- Poverty reduction to 3% by 2030.

- Soft loans for development projects.

- Promoting foreign investment and international trade.

|

- loans for infrastructure and sustainable development projects

- helping country in balance of payment (BoP) crisis

|

How much money does BRICS bank have?

| Initial subscribed capital |

50 billion (each member gave 10 billion) |

| Initial authorized capital |

100 billion |

| Contingency reserve arrangement (CRA) |

100 billion |

BRICS Contingency reserve

It is meant to help member nations fight against Balance of Payment crisis (possible because of Fed Tapering click me to know more.)

Who gave how much to contingency fund?

| China |

41 billion |

| Brazil, India, Russia |

18 billion each of them |

| S.Africa |

5 billion. |

BRICS Bank not a totally new concept!

others have done it in the past

| When |

Where |

Why/Who? |

| 60s |

Development Bank of Latin America |

Andean Nations |

| 2000s |

Chiang Mai initiative. |

- 10 ASEAN + China, S.Koera and Japan.

- To setup currency swap pacts during Asian currency crisis.

|

| 2009 |

Bank of South |

Latin American countries, due to dissatisfaction with US dominated IMF & World Bank. |

Mock Questions: BRICS Development Bank marks a “fundamental change in global economic and political power. Elaborate 200 words.

IMF Quota & Governance: Need for reforms

Old topic from April 2014. Shifting it here for better revision.

Topic was in news because G-20 countries gave an ultimatum to USA to bring reforms in IMF.

Q. Examine the need for reforms in International Monetary Fund (IMF). What will India gain from this? (200 words)

IMF was born from Bretton Woods conference to stabilize currency exchange rates and help members during Balance of Payment Crisis. But given its unequal voting power mechanism, IMF doesn’t always serve the interests of poor & developing countries, hence requires two set of reforms:

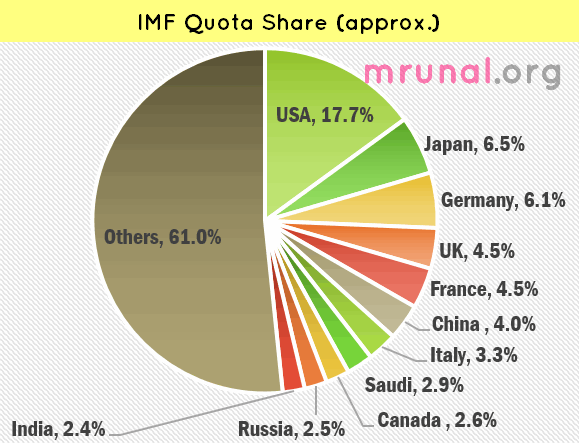

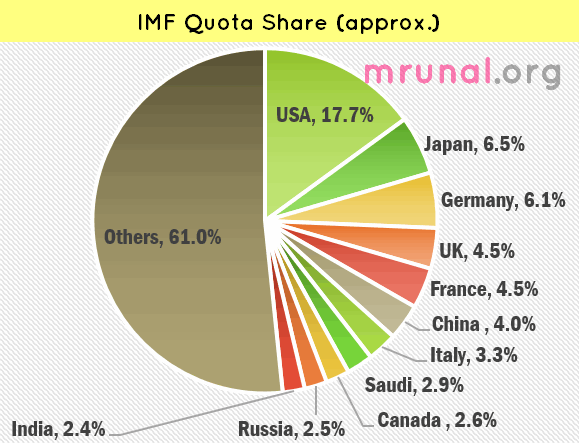

#1: IMF reform in quota

- IMF Executive board decides the Quota of each member based on various parameters including GDP and tariff barriers.

- Higher quota gives higher voting rights and borrowing permissions.

- But formula is designed in such way US has ~18% quota, G7 collectively own >40% while India and Russia have barely ~2.5% each.

- BRICS, G20 and emerging market economies are against this scheme especially after Subprime crisis and declined economic strength of USA & G7.

- 2010: Board increases quota of developing countries albeit mainly by decreasing the quota of poor countries.

- Obstacle: 70% votes required to implement this reform. Not “70” nations, but the nations who collectively own 70% quota- USA, Germany, Japan et al. Hence quota reform is pending.

#2: IMF reform in governance

- Currently in Executive board, 5 out 24 directors are permanently decided by five largest quota holders.

- 2010: new reforms proposed:

- Board composition will be reviewed every 8 years.

- All directors be elected, no permanent chairs.

- Obstacle: Requires 85% votes in favour, hence governance reform is pending as well.

#3: India’s Gain

- India wants IMF to raise the fund resources, give higher quota and powers to BRICS nations.

- If 2010’s quota & governance reforms are implemented, India’s quota will rise from 2.445 to 2.75% i.e. 11th rank to 8th rank, thus giving more voting rights, borrowing capacity and more say in the Decision Making.

~240 words.

.

.

![[IR By Pavneet 4/5] Art of Answer-writing: Directive Word#2 “DISCUSS” – Impediments to India’s permanent membership at UN Security Council (UNSC)](https://mrunal.org/wp-content/uploads/2018/07/webinar-pvnt-c-500x383.png)

sir, please write about the pradhanmantri jan dhan yojana .please……………

refer PRS site and read august monthly review.

Salient Features: Centrally Planned Approach with a difference

The salient features of PMJDY are as follows:

• To bring 7.5 crore unbanked families within the ambit of banking system.

• Providing each household with at least one bank account.

• The account opened under the scheme will have an overdraft facility of ` 5,000, a debit card and micro insurance

of Rs.1 lakh to tide over any unforeseen eventuality.

The scheme will be implemented in mission mode, having two phases.

The scheme though follows the same centrally planned approach to financial inclusion that has been practiced by the RBI

i.e. focusing on supply side by improving the delivery systems. So far such supply side measures have not met with

stunning success. We remind ourselves here that the 2006 Rangarajan Committee had suggested that while primary focus

has to be on supply side by improving the delivery systems, both conventional and innovative; the government should

also focus on demand side efforts by improving human and physical resource endowments, enhancing productivity,

mitigating risk and strengthening market linkages.

In supply side measures, three worth note efforts made by the governments include:

1. Opening maximum (no frill ) accounts

2. Business Correspondents

3. Payment Banks (Recent initiative)

Mere opening bank account is not financial inclusion, while so far the central planning model revolved around opening

bank accounts. The households have diverse demands and providing them bank account does not address all these

demands. True Financial Inclusion includes the Bank accounts, Financial Advice, Insurance, Payment and Remittance,

Affordable Credit, Savings etc. The new scheme has tried to include each of them by bringing various facilities under one

umbrella. For instance:

• It aims to bring all under banking system by providing bank account to all households

• It provides insurance cover to the family

• It provides overdraft facility (`5000) thus giving affordable credit to people

• It provides a debit card.

This way, the scheme seems to be innovative enough. Moreover, it has a marked difference from the past efforts in the

sense that central government is putting its financial resources behind this scheme. The government also says that it

intends to use this scheme to aid direct benefits transfers for various social welfare programmes. Thus, if properly

implemented, the PMJDY has potential to achieve the 100% financial inclusion goal.

Sir you are right reform in IMF/WB is need of the hour considering the size and GDP of brics countries,but these institutions are backed by western countries and pushing any reform will be a tough walk.instead we can work on expanding the members of BRICS Bank by addition of new Afro Asian countries and strengthening ADB.This will help us in long run

sir hw to add u ..hlp me..realy need to hv ua guidance…kindly eithr u add me on facebuk or email or tel me hw to do it..

great effort sir.

if sohan while selling two goats at the same prise, makes 10 % profit on one and 10% loss on other then he makes what % of profit OR wht % of loss OR no profit no loss………………………Please whts the ans explain?

loss ! approach-

10 % gain – 10% loss – ( 10*10/100) = – 1% loss

quota k matlab kya h………india loan le skta h ya india itna invest kr skta h?

viting share. of countries

THanks sir

BRICS Development Bank marks a “fundamental change in global economic and political power. Elaborate 200 words.

““What to write in political part.`????

Sir plz Add me ….

Attempted answer to the BRICS question:

For more than half a century now, the ‘Bretton Woods’ institutons, set up at 1944 conference among world powers to help nations build infrastructure (World Bank) and deal with financial crises (International Monetary Fund), have dominated the international economic scene. Due to their tilt in favour of the developed nations based on their capital contributions, they have sometimes acted as economic tools for political outcomes desired by the developed countries.

Over the last few decades, there has been growing concern among emerging economies like the BRICS nations (Brazil, Russia, Inida, China and South Africa) regarding unequal voting rights and conditions on loans given by IMF and WTO, that serve the economic interests of developed nations. This concern resulted in the formation of the ‘BRICS’ development bank – an institution fully funded by these 5 increasingly dominant economies that comprise 1/5th of the world’s GDP and 2/5th of the world’s population. The BRICS bank will provide loans for sustainable development projects and Balance of Payment crises, without conditions and has equal voting rights for all members.

Thus, with a subscribed capital of $50 billion and a contingency reserve arrangement of $ 100 billion for crisis loans, the BRICS bank promises to end the hegemony of the Bretton Woods institutions and usher in a new political and economic order.

My comment –

Phew! This was 332 words when I wrote it the first time round, have been cutting for the last half an hour to get it down to 214. I had to cut out a lot of detail about the BRICS bank as well as the Bretton Woods institutions, not sure if this answer is a good one. But how to keep to the word limit for such a huge topic? Do we take it for granted that Bretton woods is known by the examiner? Is he/she going to be looking for details like subscribed capital of the bank or its not important? Please do give feedback!!

Moderate Answer Nimisha. You have written good economical perpective but political is missing.

Bretton woods has not asked exclusively in the quetion so you dont have to write much about it.

BTW are you from MH ?

nimisha ans is gud but writing in points makes the answer more readable and concise as u dont have to add the trivial grammar , writing to the point

Italy is a chiller party,still has 3.3%quota.#Unjustice

@Mrunal: In the basics compared table, ICSID is not mentioned in components of World Bank..does it not counted as part of the group.

Yes Gautam, ICSID comes under the WorldBank Group. Probably, Mrunal would have missed in the article.

@Mrunal: In the basics compared table, ICSID is not mentioned in components of World Bank..is it not counted as part of the group.

really awsome

Hi Rohan, thanks for the feedback. I felt that the background about Bretton Woods was necessary because the question asked ‘how BRICS bank would change the scenario’ – the basic change is an alternative to the Bretton Woods system. And yes, I agree there isn’t really anything substantial on the political side, I guess one could write about China, India and Russia emerging as regional powers to challenge the might of USA and strengthening their position by coming together blah blah. MH maane Maharashtra? No I’m not from there though I worked in Mumbai for 3 years and love the city and also did my post grad from Pune.

Ash, thanks for the appreciation! I am a bit of a traditionalist that way, I prefer writing in paragraphs to just writing bullet points…is everyone writing answers that way these days? I agree it will probably help me in adding more meat to the answer. Sigh, will try to write in points now! Thank you for the feedback! :-)

Actually, just tried to write the answer as a mix of para and points and I’m able to cover much more ground with it! Yay! Thanks people! :-)

Hey guys,m a beginner for cse and going to try for cse-15.

Need help.

Cn u plz suggest me the proper strategy regarding pre and mains preparation.Should I make notes or just do reading for pre.

Plz hlp…g

Mrunal ji,

I have noticed that in several answers that u write are Point wise answers and they adhere to word limit.But is it good to leave out the pronouns etc. at the start of sentences ? We could go for complete sentences and small paras at the cost of writing less points (as agreed by one topper Neha 4th ranker i think published at your website).

Please comment..other aspirants also please help out.

what is balance of payment crisis?

What is expected cut off marks for IBPS PO exam in general category ………?

result date of IBPS PO exam????

Sir ,wht is balance of payment crisis?