- Why BASEL norms?

- How can a bank acquire new capital for BASEL-III

- INDRADHANUSH

- why Rs. 2.11 Lakh crore Recapitalization plan?

- Bank recapitalization Bonds (Rs.1.35 lakh cr.)

- Criticism of Rs.2.11 lakh package

- What if banks refuse to comply with BASEL-III norms?

- What is RBI’s Prompt Corrective Action framework (PCA)?

- What is DFS’s EASE Framework?

Why BASEL norms?

Let’s first check ICICI’s balance sheet (2016-17):

| Capital | +Liabilities | =Assets |

| Equity : ~1200 crores | Deposits: ~5 lakh crores | Loans ~4.6 Lakh crores |

| Debt: ~1.5 lakh crores | Deposits @RBI: ~31,000 crores | |

| +other assets |

- So, a bank with mere 1200 crores of share capital is commanding deposits worth ~3% of India’s GDP.

- Such banks grow very arrogant that we are “too big to fail”, so, even if something goes wrong, entire economy might collapse, therefore, RBI will not immediately shut us down, Government will give us some type of bailout package etc.

- Next comes the controversy where ICICI chief Chanda Kochar allegedly passes Videocon loan worth Rs.3250 crores without due diligence, for a bribe of Rs.64 crores indirectly given to Chanda’s husband.

- So, how can we prevent banks from becoming too large and thereby too arrogant?

- Option-A: We should put quantitative ceiling on individual banks- “you can’t have more than 1000 clients, and from each client you can’t accept more than 1 lakh rupees deposit.” But this will hurt financial inclusion and growth of banking sector.

- Option-B: We should put strict investment norms on the asset side of banks: “you must invest 72% of your deposits in gold and Government securities”, but this will bottleneck the flow of cheap loans to needy borrowers.

- Option-C: We should allow banks to accept as much deposits they can mobilize, and allow them to loan out as much money as they can, provided that they’ve sufficient capital for the equation: Capital + liabilities = assets.

This is the rationale behind BASEL norms:

- BASEL Committee on banking supervision sits @BASEL, Switzerland. They made norms in 1988 (I), 2004 (II), 2011(III).

- Under BASEL-III norms, first, a bank needs to calculate its risk-weight assets (RWA). And accordingly, it needs to maintain

- 1) Minimum Capital

- 2) Capital conversation buffer (CCB) and

- 3) counter cyclic capital buffer (CCCB)

- Plus other technical things, not important for competitive exams.

Suppose a bank has balancesheet like this:

| Capital | +Liabilities | =Assets |

|---|---|---|

| Equities (shares): Rs. 1 | Deposits: Rs.99 | CRR, SLR: Rs.23 |

| LCR:HQLA: Rs.3 | ||

| Good loans: Rs.68 | ||

| Bad loans: Rs.6 | ||

| Assets = Rs.100 | ||

| Risk weighted assets (RWA) = Rs.120 ** |

** This is calculated using BASEL’s norms, we need not bother with it, but the gist is- more bad loans you’ve, higher this RWA figure will become.

BASEL-III norms mandate that by 31/3/2019, Indian Scheduled commercial banks (SCB) must have “capital to the risk weighted assets ratio” (CRAR) of 9%. So,

- Min capital to RWA = 9%

- In our case, capital is Rs.1 and RWA = Rs.120, so (1/120) x 100 = less than 1%.

- But if this bank had capital of Rs.11 then (11/120) x 100 = 9%. Meaning, bank needs capital of Rs. 11 (required) minus 1 (existing) = Rs.10 recapitalization is reqired.

- Apart from 9% CRAR, the banks also need to maintain + Capital conversation buffer (CCB) and Counter Cyclic Capital Buffer (CCCB). But this much knowledge not important for UPSC.

- Point is: asset qualities degrade; bank will need more capital.

(UPSC-Prelim-2016) Objective of BASEL-III norms?

- Develop national strategies for biological diversity

- reduce the GHG emissions but places a heavier burden on developed countries

- transfer technology from developed Countries to poor countries to replace chlorofluorocarbons in refrigeration

- improve banking sector’s ability to deal with financial and economic stress and improve risk management

h/ it should be evident from above EASY MCQ that UPSC is not asking technical questions from BASEL-III, because it’s a recruitment exam for civil servants not bank-officials.

How can a bank acquire new capital for BASEL-III

| Equity | Debt |

|---|---|

| Bank should issue additional shares. If bank makes profit, it will give dividend to the investor. | Bank should issue bonds. Pay fixed interest to investor, irrespective of whether bank is making profit or not. |

| Punjab National Bank (PNB) has given Rs.0 dividend to investors for 2016 and 2017 because it’s not making any profit. So, if PNB issued new shares, only a बेवकूफ (idiot) will invest in it. | That means PNB should issue bonds. But here too, investors know this bank is making losses, so, they’ll demand higher interest (say 36%) for the risk they’re taking. |

- So, no wies investor will buy PNB’s shares and If PNB casually issues bonds @36% to comply with BASEL-III, still we know that borrowing @36% is an unsustainable business, PNB will default on interest payments sooner or later.

- Therefore, BASEL-III capital requirement has internal quota of Tier-1 capital, tire-2 capital, equity capital, debt capital… we need not go in technical details, but the bottom line is BASEL-III norms have higher “EQUITY CAPITAL” requirement. वरना तो भारत के सरकारी बेंक इतने बेशिस्त और बेगेरत है की वे ७२% ब्याज पे भी बांड बेच के अपना पुन:पूंजीकरण कर सकते है. लेकिन एसा खेल पूरी अर्थव्यवस्था को तबाह न करे, इसलिए BASEL-III में tier-1, tier-2, debt capital vs equity capital एसे तकनिकी क्वोटा बनाये गये है.

INDRA-the Tiger nhi but INDRA-the-DHANUSH

- Since Indian public sector banks don’t have the औकात (capacity) to comply with BASEL-III norms on their own, therefore, Finance ministry’s Department of Financial services came up with INDRADHANUSH PLan for recapitalization of public sector banks under which, phasewise they’ll be injected with capital:

| Financial Year | PSB Recapitalization by Government |

|---|---|

| 2015 | Rs. 25,000 crores |

| 2016 | Rs. 25,000 crores |

| 2017 | Rs. 10,000 crores |

| 2018 | Rs. 10,000 crores |

| Total | Rs. 70,000 crores from Government. |

- Indradhanush plan also had provisions to ensure various administrative reforms in PSB. For example, PSB chiefs’ salaries were linked with key performance indicators like how much NPA they recovered, how many new Jan-dhan accounts they opened etc.

- Earlier it was thought that PSBs will requires Rs.1.8 lakh crore addtional capital by 31/3/19 to comply with BASEL-III norms. So, Government will give Rs.70k crores, and PSBs will mobilize remaining capital from market by issuing shares and bonds.

why Rs. 2.11 Lakh crore Recapitalization plan?

- By October 2017, it became clear market will not help much in PSB’s recapitalization-walle shares and bonds because every PSB is running in losses, only a bewkoof will invest in it.

- This meant Government will have to bear greater share of recapitalization burden.

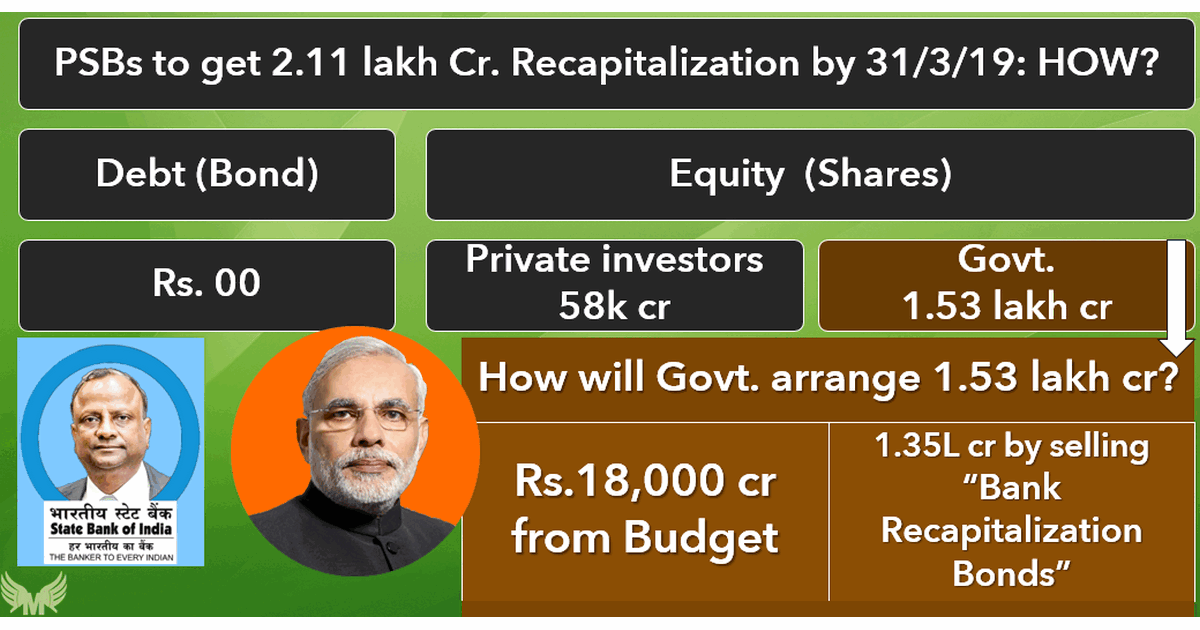

- In October 2017, Modi Government announce Rs. 2.11 lakh crore recapitalization package for PSB. The fact that FinMin bureaucrates didnot give Sansktriized name for this project to please PM Modi… it shows how much serious and emerency this task was for them!

- As we learned earlier, there are two ways to arrange capital: debt and equity

| Debt (Bonds) | Equity (Shares) | |

|---|---|---|

[00] Meaning PSBs themselves will not issue any bonds. Because

|

PSBs will sell Rs.58,000 crore worth shares to private investors. | PSBs will sell Rs.1.53 lakh crore worth shares to Government. Then next question is how will Government arrange this amount? ans.

|

Out of above commitment, Government will give 8k crore (via Budget) + 80k crores (via bonds) = Rs.88k crores by 31/3/2018. But we need not bother with these figures for UPSC prelims.

Bank recapitalization Bonds (Rs.1.35 lakh cr.)

2018-January: Government announced following features of the Bank-recapitalization bonds.

- These bonds will have interest rate of 7.68-7.48%

- These bonds will mature at 2028-2033.

- These bonds will be Non-transferable to third party i.e. investor will have to hold the bonds till maturity.

- These bonds will be non-convertible i.e. they can’t be converted into shares.

Now comes the question: who will buy these recapitalization bonds with such stringent norms and long-tenure?

- Ans. Public Sector Banks (PSBs) themselves will buy these bank-recap-bonds using juntaa’s deposits (mostly fixed deposits).

- Government gets money.

- Government then asks PSBs to issue new shares.

- Government will buy those PSB-shares using money earned from Bank-recap-Bonds.

- Thus PSBs get the equity capital to comply with BASEL-III norms by 31/3/2019.

- (if) PSBs make profit, they’ll share dividend with Government (because Government owns more shares).

- From that dividend, Government will pay-off that ~7% interest rate to PSBs (Because PSBs have invested in Government’s bank-recap-bonds).

- However, critiques say PSBs will not generate sufficient dividend to finance entire interest payment.

- So, Government will have to bear interest-payment from its own pocket (=tax payers’ pocket). This will increase fiscal deficit, unless Government cuts down Expenditures elsewhere. OR Government could then launch new bonds to repay interest on these old bonds!

- Thus 1.35 lakh cr. Bank recap bonds are merely a ‘creative-accounting’ wherein Public sector Banks’ own deposits are used for injecting capital in them.

Criticism of Rs.2.11 lakh package

Hidden objective of Demonetization

- Critiques argue that Modi launched demonetization with this hidden-objective so that junta’s money is mobilized into bank deposits, and then PSBs will be ordered to use same deposits for financing this recapitalization bond drive.

- यानि की उद्योगपतिओ के लोन वापस न करने के कारण जो TBS/NPA/higher-BASEL requirement की नोबत आई है, उससे निपटने के लिए ही नोटबंधीं (विमुद्र्रीकरण) किया गया था, जबकि काला-धन तो तबाह हुआ ही नही, क्योकि ९९% पुराने नोट तो बेंको में जमा हो गये थे!

Financial repression (वित्तीय दमन)

- Government will mobilize Rs.1.35 lakh crores by selling bank-recapitalization-bonds.

- but ordinary investors are unlikely to buy htese bonds due to their tough norms on interest, tenure and liquidity constrains (because they’ve to be held till maturity, can’t sell off as per your needs unlike ordinary shares)

- Therefore, Government will force PSBs, LIC, EPFO, UTI-Mutual-funds, NPS, Atal-Pension-Yojana and other Government owned financial institutions/ schemes finance this package.

- Since bank-recap-bonds offer less than 8% interest, so, the indirect investors i.e. FD holders of PSB, policy holders of LIC/EPFO etc. can’t hope for more than 8% return on their investment.

- This is called financial repression of the household, because they could have enjoy higher returns, had those Public-sector-Ffinancial Intermediaries invested their money in more lucrative avenues like relianceJio or Apple.

- Out of Rs.2.11 lakh crore package, Rs.58,000 crores are to come via equity finance from private investors. But it’s unlikely that private investors will buy that much shares. So again LIC/EPFO etc. will bear the brunt.

- Counter argument #1: RBI is mandated to keep the inflation in range of 2-6%. So, even if someone earns ~7-8% return, he’s getting a positive real interest rate over inflation. so, both his money and his purchasing power will improve over the time. इसलिए केवल ७%-८% इतना कम रिटर्न क्यों है, एसी हाय-हाय नही करनी चाहिए.

- Counter argument #2: It’s true that Government is making PSBs to use juntaa’s deposits to buy bank-recap-bonds to indirectly recapitalize them, but if Government had not done that, then Government will have to sell these bonds to private investors- that would have led to ‘crowding out of private investment’ i.e. Market is financing Government instead of corporats. Then to compete against Government’s bank-recap-bonds, Mukesh Ambani will have to launch jio-bonds with even higher interest rate.. but that’ll make his business less profitable. So, companies will postpone their expansion plans, bye bye job growth and GDP. So, it was better that Government and PSBs used this ‘creative-accounting-method… घी गिरा तो खिचड़ी में ही!

Moral Hazard (नैतिक खतरा)

- In past also Government had given capital injection to PSBs. Still their NPA continues to rise. It proves that PSB-bankers have don’t have any motivation to remain disciplined / improve their performance, because they know- that Government will rescue us with such capital injections! IF Government tries to shut us down, or merge us with other bank then our staff-union will go on hartal!

- it’s just like a person with medical insurance becoming careless with his diet and exercise, because he knows medical bill will be bourne by insurance company.

- So, Rs.2.11 lakh cr. package will create a similar moral hazard.

- Counter-argument: Government has enacted E-A-S-E framework to improve the performance of PSBs (2017, November). Not all 21 PSBs will be fully capitalized. Weaker PSBs will be left to their own fate.

What if banks refuse to comply with BASEL-III norms?

- IF RBI Governor Urjit Patel starts “Mohd.Jinnah-giri” @BASEL-meetings, then Indian banks need not arrange this capital. But it’ll lead to loss of face for RBI and India as a country, and it’ll weaken the indian and global economy. Finance ministry had even asked RBI to extend the deadline from 31/3/2019 for one year, but RBI didnot entertain this request for the same reason. यानि की ये पुन:पूंजीकरण कोई कोलेज एसाइनमेंट नही की पोस्टपोन कर सके.

- It’s immaterial how much deposits your bank has in current account, saving account, fixed deposits, …because BASEL-III norms look at your bank’s capital adequacy.

- So, if a bank can’t comply with BASEL-III then it’ll have to reduce its lending operations and dispose-off its bad loans [so that automatically RWA declines, and banks existing capital becomes sufficient to comply with BASEL-III’s percentage norms].

- In worst case, bank will have to sell off its business to some other bank or shut down.

- In India, RBI has prompt corrective action framework (PCA), under which weak banks’ business activities are put on restriction. In worst case, RBI can even force shutdown / merger of such banks. [11 PSBs already in this PCA-list.]

Side topic: What is D-SIB?

- In 2010, G-20’s brainchild Financial Stability board (HQ BASEL) asked countries to identify systematically important Financial institutions, and put framework to reduce risk in them.

- Accordingly, RBI designates domestic systematic important banks, in August each year (since 2015).

- These large banks have to keep additional equity capital against their risk weight assets.

- Total three D-SIBs in India: SBI, ICICI, HDFC (Latest Entry).

What is RBI’s Prompt Corrective Action framework (PCA)?

- 2002: RBI Governor Bimal Jalan designed this framework.

- 2017: Urjit Patel toughened it further.

- RBI monitors all commercial banks on parameters such as BASEL-III Capital to Risk-weighted Asset Ratio (CRAR), Net NPA, Return on Assets etc. Accordingly, banks are classified into risk threshold #1, #2, #3. Higher the number, higher the risk.

Then RBI will corrective actions such as:

- Restricting bank’s directors’ salaries and dividend distribution

- Restricting banks’ branch expansion.

- Forcing merger / shutdown of a weak bank (under Banking regulation Act 1949).

By 2018, 11 out of 21 public sector banks are in this PCA list viz. Dena Bank, Central Bank of India, Bank of Maharashtra, UCO Bank, IDBI Bank, Oriental Bank of Commerce, Indian Overseas Bank, Corporation Bank, Bank of India, Allahabad Bank and United Bank of India

What is DFS’s EASE Framework?

| 2014 | RBI’s P.J.Nayak Committee suggests creating a banking investment company (BIC). Then Government should transfer its shares from PSBs in this BIC, for more professional management of PSBS without Government interference. |

| Economic Survey 2014-15 | It suggested 4R reforms viz.

|

| 2015, January |

|

| 2015, August | Based on the recommendations of Gyan-Sangam-I, Department of financial services initiated following reforms

|

| Economic Survey 2015-16 | It suggested 4D reforms viz.

|

| Economic Survey 2016-17 |

|

| 2016, March |

|

| 2016, April |

|

| 2017, October | Rs. 2.11 lakh crores package for Bank Recapitalization. |

| 2017, November | First Public Sector Bank (PSB)-Manthan organized by Department of Financial services (DFS) at Gurugram. Here recommendations were made to improve the functioning of PSBs. |

| 2018, January | DFS announces “EASE Agenda”. |

Enhanced Access and Service Excellence (EASE) agenda

Who? Department of financial services

Theme? Responsive and Responsible PSBs using six pillars:

- Customer Responsiveness

- Responsible Banking

- Credit Off Take

- PSBs as Udyami Mitra

- Deepening Financial Inclusion & Digitalization

- Developing Personnel for Brand PSB.

The gist of above features, can be summarized as following:

EASE for Depositors / financial inclusion

- Banking outlets within 5 km of every village.

- Bank-Mittra, Mobile ATM, arriving at pre-designated time.

- Selling PM Suraksha Bima Yojana (PM-SBY), PM Jeevan Jyoti Bima Yojana (PM-JJBY), PM Fasal Bima Yojana (PM-FBY) and other Micro insurance.

- Unauthorized debit in digital payment: refund in 10 working days.

EASE against “NPA” & losses

- Each PSB has to appoint Chief risk officer: Risk limits & Risk based pricing.

- Online One-time settlement of bad loans (with haircuts.)

- Setup a Stressed Asset Management Vertical (SAMV) for Special mention accounts (SMA) i.e. accounts on which principal / interest is due for 0-90 days.

- Hire Agencies for Specialized Monitoring (ASMs). They will conduct audit & inspection on corporates who receive loans above Rs. after 100 cr.

- Differentiated Banking Strategy (DBS): PSBs will have to reduce corporate exposure to below 40% (2019) by asset swap with smaller banks. Similarly branch & HR rationalization plans.

- Shut down non-viable overseas branches, consolidate ops with other PSBs.

- Sell non-essential real estate & equity investment in unrelated / non-core business. Criticism: PSBs will lose out to ICICI, HDFC et al in merchant banking, underwriting, insurance etc. non-core businesses.

EASE for Borrowers

- PSBs will have to create mechanism for online retail loans (home, auto, education.)

- PSBs will have to help MSME entrepreneurs via Udyamimitra.com. On the loan applications received on this portal, they’ll have to take decision within 15 days. There will be max. 3 layers in decision making for loan approval.

- Feet-on-street: PSB managers will have to reach out to borrowers, esp. entrepreneurs with the help from FICCI, chamber of commerce etc.

- PSBs will do Credit “+” (plus) approach i.e. help entrepreneur in marketing, insurance, expanding his biz.network etc. in addition of sanctioning his loan.

- PSBs will appoint Special MSME relationship officers. PSBs will also try to revive SMA-1 and SMA-2 accounts of MSME entrepreneurs.

- Benefits for above reforms: “Egalitarianism” as MSME industry will create new jobs.

EASE for Personnel (HR)

- Performance management system- annual appraisal.

- Job families: “grouping of jobs with similar characteristics”, then posting, promotion, transfers accordingly. Manager- Accounts: Regulatory compliance with RBI, Sales: Biz-intelligence.

- Training, E-learning programs, skill development, fellowship.

- Criticism: specific promises not given in terms of variable pay, hire-fire.

Accountability for the EASE framework

- Each whole-time director of a PSB will be entrusted with one framework e.g. customer responsiveness, responsible banking and so forth.

- Their performance will be checked by the PSB’s board.

- An independent agency will be tasked to check public perception.

Next Article: Selected Current Affairs related to Share market, Insurance Sector. Then BES182: Budget, 15th FC.

![[Win23] Economy Pill4ABC: Sectors: Agri, Mfg, Services, EoD, IPR related annual current updates for UPSC by Mrunal Patel](https://mrunal.org/wp-content/uploads/2023/04/win234b-500x383.jpeg)

![[Economy] BOT-PPP Model for Highways, Right to Repair, WTO & Foodgrains Exports- Weekly Mrunal Digest from Jul week1-2022 (WMD)](https://mrunal.org/wp-content/uploads/2022/07/ppp-bot-500x383.jpg)

The Simplest ONE…..

Thank You Again Sir

Thankyou sir

thank you so much sir

Thank you..so much sir

While reading this whole Article..your voice sounds in a ear..

Ur article itself have a mrunal quality..

Once more..thanks aton

same here. Everytime…!

Jai ho gurudev ki

Thank you very much sir….

Thank you sir ji

आप के सामने सब फेल | जय हो गुरु मृणाल की |

Thank u sir

Mrunalism! Its weird that, I can here you lecture through these articles! You’re like one of those childhood memories/treasure which we feel nostalgic about and treasure all the while whenever we recollect.. Thanks very very much Guru….

cant agree more..u just said what i wanted to say.i guess most of us feel the same way…

Exactly! Thanks Sir

Ek baar 5-10 miniute ke online youtube pe ajayen, dekhna kitne log apko wait karke baithe hain…Plz come, not for study, kuch bhi bol dijiye, chen milta hai.

Sir no need of lecture series your articles are enough to fulfill my knowledge thirst

Thanks Sir . Now I am feeling that i am at right place

sir im your very old shishya ( student) 8/9 years old .. this prelims please give us some magic notes just like every year ..like i always say Mrunal Rocks…\,,/

hello sir, thanks for articles. can you also post pdf for the same article I can’t read for long time on laptop.

thanks a lot sir

And this is why Mrunal Sir is the best!

Sir, PLease ye bata dijiye ki OLD VIDEOS me se kewal first 35 hi dekhne h ya aur bhi important h…

Please other important videos bhi list karke bata dijiye….

Thank you sir…. Aap jo kar rahe h wo AMULYA hai…

Nhi…. 35 ke baad waale imp nhi hai kyunki exam paper mrunal sir ne set kiya hai….. imp video ki list kyu, pura questions ki list le lo…..

Sir ne hi likha h 35 videos dekhne ke liye… isliye puchh raha hu… Mujhe lag raha h ki sare hi dekhne chahiye… Mujhe itna samajh aaya ki 35 videos ke baad sir yaha pe cover karenge…

Dear sir, please complete the whole survey before 20 may …

i still have faith over mrunal sir..unhone kaha hai ki ayega 182 aur aage ka toh ayega chahe ek din pehle hi aaye…tab bhi padh kar jayenge…vaise bhi sahi hai revision ki jarurat nhi padegi agar late padhenge toh..aur mrunal sir must be making the bes series pre oriented isiliye der ho rahi..dekhn ayega..i have full faith..

sir please complete BES18 series .

Sir, when you publish next article BES 182 ?

is BES182 series started by sir .please help.

Sir i want to download updated video of BES18 as i have downloded BES 17 video already…but not able to download updated video now ….PLs help

BES182: Budget, 15th FC ?

is BES182 series started by sir .please help.