- BES171/E-Payment #1: MDR, PoS, Interoperability, BharatQR, Ratan Watal, C.Naidu Committee

- BES171/E-Payment #2: Budget penalties on Cash, Lucky Grahak, Paygov, NTRP, DipYAN,

- BES171/E-Payment #3: Mains Answer writing Practice on Digital Payment

Prologue: from now on, from now on, all Powerpoint available at https://mrunal.org/powerpoint

BES171/E-Payment #1: MDR, PoS, Interoperability, BharatQR, Ratan Watal, C.Naidu & Budget provisions

- In earlier parts, we learned the MCQ, objective type theory and current affairs for digital payment systems and mobile banking.

- Now let’s move to analytical and descriptive aspects for UPSC mains and interviews

- As such, Government of India had constituted Ratan Watal Committee and then Chandrababu Naidu Committee to suggests ways to increase digital payments in India. Later, even economic survey of India and Yojana February 2017 also suggested measures make India a less cash economy.

- In this session, we’ll look at those challenges and reforms, including the provisions made in the latest budget.

- On the technical side, challenges include 1) merchant discount rate (MDR) and KYC norms for buying PoS terminals vs latest BharatQR code. 2) interoperability i.e. ability to move money from one platform to another and 3) scams and regulatory structure.

- As recommended by Ratan Watal, the latest budget mentioned setting up a separate payment regulatory board (PRB) under RBI to take over the functions of erstwhile BPSS for monitoring digital payments.

- In this episode, we’ll take a look at all three of them- including their challenges and reforms.

Youtube Link: http://youtu.be/ryNXnY8Sje0

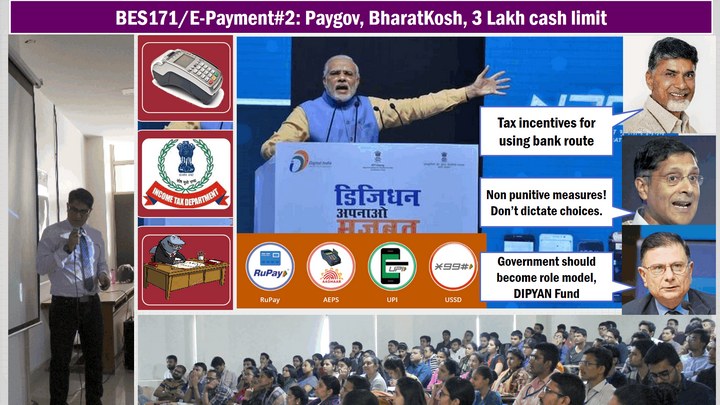

BES171/E-Payment #2: Budget Tax incentives, Lucky Grahak, Paygov, NTRP, DipYAN,

- Continuing from the previous episode, here we’ll finish with the remaining three challenges to adoption f digital payment system in India viz 1) Government itself is not role model, 2) lack of financial literacy 3) even those who’re aware, not changing their behavior.

- While Government of India launched two portals for e-transactions 1) paygov 2) Non-tax reciept portal BharatKosh, and launched Digital financial literacy campaign under HRD ministry, but overall, Government itself is not a role model when it comes to adoption of digital payment in internal functioning.

- Ratan Watal Committee suggested a new fund “DIPYAN” from the savings of digitization and use it for further promotion of digital payments.

- Chandrababu naidu suggested income tax relief for families using digital payments. Budget also used certain ‘carrot-and-stick’ approaches to make households, firms and political parties to use banking routes more than cash methods, this includes section 269ST, 217DA and other amendments in Finance bill 2017.

- NITI Ayog and NPCi also offering lottery schemes such as lucky grahak yojana for adoption of e-payment methods but is this sustainable in long run? Economic survey has some interesting conclusions. We’ll see all this in the present episode.

Youtube Link: http://youtu.be/44HrMNxWyxs

BES171/E-Payment #3: Mains Answer writing Practice on Digital Payment Mock Questions

- Answer following questions in 200 words each, and then start the video for model answer framework and common mistakes:

- Examine the challenges against usage of digital payment in India, and suggest remedies. (200 words)

- Discuss the significance of following, in making India a “cashless economy: (i) “interoperability (ii) “blockchain technology. (200 words)

Youtube Link: http://youtu.be/_4n46Nwvs_M

from now on, from now on, all Powerpoint available at https://mrunal.org/powerpoint

Next lecture: we’ll start with evolution and classification of banking and financial intermediaries in India, including latest budget provisions and current affairs including Indian Postal Payment Bank (IPPB).

![[Summary] Budget & Economic Survey 2018 Gist for the UPSC IAS/IPS Interviews](https://mrunal.org/wp-content/uploads/2018/02/c-bes18-basanti-500x383.jpg)

![[BES171] Banking-Classification: Wholesale Banks, Cooperative Banks, DFI AIFI, MUDRA Bank, Islamic Bank, NBFCs & Indigenous Moneylenders](https://mrunal.org/wp-content/uploads/2017/05/c-bes171-evo-2-500x383.gif)

![[BES171] Banking-Classification: RBI Structure Functions, Nationalization, Scheduled Banks, Merger of SBI Associate Banks & BMB, Private Banks, SFB & Payment Banks](https://mrunal.org/wp-content/uploads/2017/02/c-bes171-cover-500x383.gif)

Sir Ji,

Only 3 months left…Please upload upcoming lectures as soon as possible….Kripa ho jaegi hm gareebo pe..

Sir when you’ll upload the next video sir

Thank you mrunal sir your lecture series is very useful Please upload next videos and it’s ppt sir

Sir, When will be the next pillars of BES171 come up?

Guys…I think we should continue our preparation with old videos by updating ourselves.Because right now sir is busy with mock interview preparation. So without losing time in waiting we should continue.

R/sir,

We understand that you must be having some reason for not coming up with new lectures. But can you suggest us waht to prepare as homework? so that we can reduce our last minute burden.

Sir kindly upload next videos of BES171 series

Thank you mrunal sir,your BES171 series is very helpfull for us and pls new lecture……..video

ham vidharb rural area se(MH) se hai

Sir pls help us